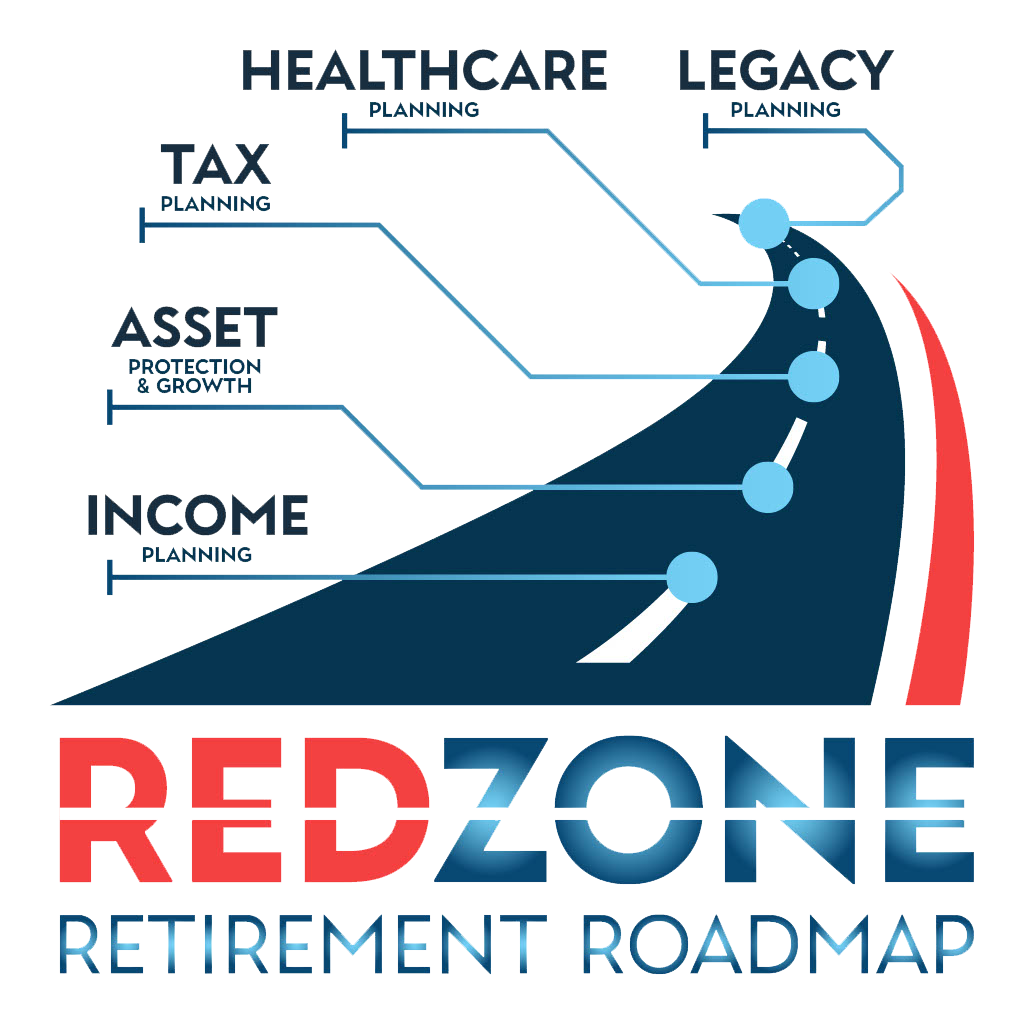

Our Red Zone Retirement Roadmap Process

Anticipation—Instead of Apprehension or Resignation

Your Retirement, Your Roadmap

No two retirements are the same, which is why the Red Zone Retirement Roadmap is designed to be customized to your unique needs. Through our Philosophy, Planning Strategy, and Process, we provide a clear path to financial security—so you can step into retirement with confidence, knowing you have a plan for every stage ahead.

Ready to take control of your financial future? Contact us today to start building your personalized Red Zone Retirement Roadmap.

According to recent studies, the number one fear of those approaching retirement is outlasting their retirement nest egg. The uncertainty of market fluctuations, healthcare costs, and tax burdens can create anxiety about the future.

But what if you could enter retirement with anticipation—looking forward to new experiences and opportunities rather than fearing financial instability? What if you could feel confident that your retirement lifestyle is secure, knowing that you have a plan in place to navigate the years ahead?

At Capital Resource Group, we believe retirement should be a time of enjoyment, not stress. That’s why we created the Red Zone Retirement Roadmap—a comprehensive planning process designed to help you prepare for and confidently navigate retirement’s financial challenges.

The 5 Key Areas of Retirement Planning

The Red Zone Retirement Roadmap is built around five critical areas that work together to create a strong financial foundation:

- Income Planning – Ensuring a reliable, sustainable income stream that supports your retirement lifestyle. We help you optimize withdrawals, Social Security, and pension strategies to balance security and flexibility.

- Asset Protection & Growth – Protecting your hard-earned wealth from unnecessary risk while ensuring it continues to grow to support your long-term financial needs.

- Tax Planning – Minimizing tax liabilities to help you keep more of your money. We implement proactive strategies to optimize your tax situation throughout retirement.

- Healthcare Planning – Preparing for rising healthcare costs, including Medicare, long-term care, and unexpected medical expenses, so you can avoid financial stress if health issues arise.

- Legacy Planning – Structuring your estate to ensure your wealth is passed on according to your wishes, while minimizing taxes and legal complications for your heirs.

A Collaborative, Proven Process

To help our clients chart their financial path, we follow a structured approach that cushions the effects of critical financial events and ensures you achieve your wealth and lifestyle goals.

We start with three key steps:

🔍 Learning Your Goals and Objectives – Every retirement journey is unique. We begin by understanding your aspirations, concerns, and financial situation.

📋 Addressing Your Critical Life Events – Whether it’s healthcare planning, tax-efficient wealth transfers, or structuring income, we anticipate and plan for the key events that could impact your retirement.

🚀 Overlaying Our Proven Process to Find Solutions – Using our Red Zone Retirement Roadmap, we design a tailored financial strategy that integrates income, investments, taxes, healthcare, and estate planning.

And we don’t do it alone. Retirement planning is complex, and the best results come from a collaborative approach. We work closely with a network of trusted professionals, including Legal Advisors, Tax Advisors, and Estate Advisors, to ensure every aspect of your plan is structured for long-term success.